Learn how the exceptional financial and operational progress of Agency Holding Companies will impact brand advertisers in the future.

After a careful review of the earnings reports of these global leaders in advertising and communication, we compiled a few key takeaways about their 2022 performance and, more importantly, what it means for advertisers.

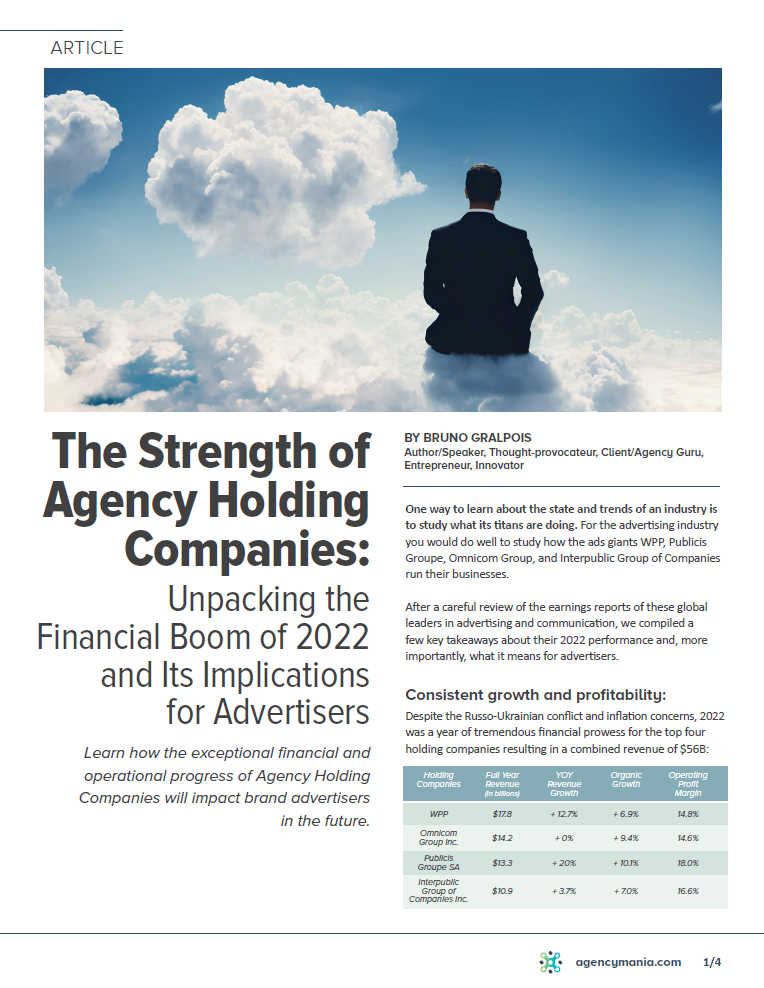

Consistent growth and profitability:

Despite the Russo-Ukrainian conflict and inflation concerns, 2022 was a year of tremendous financial prowess for the top four holding companies resulting in a combined revenue of $56B:

| Holding Companies | Full Year Revenue

(In billion) |

YOY Revenue Growth | Organic

Growth |

Operating Profit Margin |

| WPP | $17.8 | +12.7% | +6.9% | 14.8% |

| Omnicom Group Inc. | $14.2 | +0% | +9.4% | 14.6 % |

| Publicis Groupe SA | $13.3 | +20% | +10.1% | 18.0% |

| Interpublic Group of Companies Inc. | $10.9 | +3.7% | +7.0% | 16.6% |

Source: Earning reports

Year-over-year revenue performance was a mixed bag, with Publicis Groupe leading the pack. Yet, all four agencies had strong organic growth, ranging from 7% to 10.1%. Organic growth is a key financial indicator that excludes acquisitions and the effects of exchange rates, providing a more accurate view into the performance of a company.

Operating profit margin, which is the ratio of operating income to net sales and includes operating expenses like overhead, is also a great indicator of a company’s financial health. In this instance, all four reported double-digit operating profit margins in 2022 with an average of 16%, on par with large management consulting firms. As a point of comparison: Accenture, which reported more revenue than all four holding companies combined ($61.6B), achieved 15.2% in operating profit margin. Looking more broadly, the operating margin for S&P 500 was 11.8%. The advertising sector does prove to be quite healthy. For advertisers, having financially healthy partners is desirable as it provides greater stability, a better talent pool, less financial friction, and more balanced relationships.

Improved expense management and bottom-line efficiencies:

During the COVID crisis, every company carefully evaluated expenses and looked for ways to reduce overhead or excessive costs in anticipation of tighter economic times. For holding companies, most expenses are concentrated on talent payroll and real estate. For example, personnel costs (salaries, commissions, bonuses, profit-sharing, etc.) for Publicis Group add up to 64% of net revenue or more than $8B.

In 2022, most agencies successfully reduced their real estate portfolio given shifts in their company’s workforce model including more work-from-home type of work arrangements and less dependency on in-person client meetings to conduct business. And it worked. IPG is on track to save $20M annually. WPP already realized $448M in savings and plans to deliver $717M savings by 2025 by consolidating IT hubs, reducing travel, and relying on fewer campuses.

These improvements in expense management allow the agencies to reinvest in productivity tools, higher wages and staff incentives for talent retention, increased headcount, and developing skillsets in growth areas such as experience, commerce, data, and technology. Having agencies manage expenses carefully is beneficial for advertisers as it leads to more efficient and streamlined operations, which may result in better capabilities as well as cost savings that can then be passed on to advertisers in the form of lower prices or better value.

Simplification of agency brands and offerings:

The agency world is inherently complex because advertising is increasingly more diverse, specialized and, well, multifaceted. In response, holding companies made several strategic mergers and acquisitions and created specialized solutions for clients. Their offerings, unified and fluid by design, in practice, however, are increasingly complicated for their clients to navigate.

Looking at the list of agency brands under a single holding company can be overwhelming and confusing. As a result, holding companies constantly restructure, close business units, and even consolidate to provide a more integrated, simplified offering. That was the case for WPP which removed 267 legal entities in 2022 and merged agencies to form EssenceMediacom, GroupM Nexus, and Design Bridge and Partners. Yet, simplifying remains a challenge given the scale and inherent complexity of disciplines like Media. As an example: WPP’s media offering today include GroupM, the world’s leading media investment company contributing more than $63B in annual media investment through its agencies Mindshare, Wavemaker, mSix&Partners, and EssenceMediacom.

WPP is not alone in streamlining and revamping its operations. To sustain its solid financial performance, Publicis Groupe built a platform organization based on a country model, with a single P&L per geography, leveraging its backbone Publicis Re:Sources and Global Delivery Centers to provide a scaled talent pool to its clients.

The goal of all this restructuring is to reduce complexity and cost while responding more quickly to client needs. Advertisers do benefit when agencies streamline operations and improve collaboration with less moving parts. Agency talent is easier to access. And capabilities are easier to leverage.

Integrated approach to staffing and servicing clients:

One of the ways by which agencies are simplifying their offering to service clients is by introducing standalone agencies or setting up dedicated bespoke teams. These entities co-locate the agency resources to ultimately lead to bigger ideas and more efficient, strategic, and faster execution.

A prime example is WPP’s integrated team called Red Fuse, which is dedicated to serving Colgate-Palmolive worldwide. Red Fuse includes talent from WPP’s agencies VMLY&R, Wavemaker, VMLY&R Commerce, and Ogilvy and has offices in New York, Hong Kong, Paris, Mumbai, Kansas City, Sao Paulo, and Prague. Other WPP examples include Coca-Cola’s OpenX, L’Oreal’s L’Equipe, Mazda’s Garage Team, BP’s Team Energy and more.

Publicis Groupe refers to this integrated approach as “The Power of One”, combining resources from its vast network of media, technology, data, and creative resources and orchestrating work from a single team like PLUS+ for Pepsico, Heineken’s Le Pub, or the Publicis Production model for Mondelez International.

Although WPP and Publicis lead the pack in terms of setting bespoke units and dedicated agencies for major clients, IPG MediaBrands and Omnicom Group also had successful implementations in recent years such as TBWA/Media Arts Lab for Apple, La Maison Media for Chanel, or Nissan United. Large global advertisers will continue to benefit from this type of agency partnership, accessing a wider set of resources, co-located around the world and across specialized agencies while organized around a single P&L to simplify the contractual relationship.

Accelerated investment in data and technology:

Data and technology are critical capabilities for agencies to address current and future marketing challenges faced by advertisers trying to strengthen every touchpoint of the customer journey. As client spend shifted towards first-party data management, e-commerce, and business transformation, agencies responded with an arsenal of specialized tools and resources.

Seamless integration of these capabilities into media and creation boosted performance significantly. Naturally, this is where agencies see most growth and long-term profitability. For example, Publicis Groupe’s data and tech offering (mainly through Epsilon and Publicis Sapient entities) now represents one-third of the company’s revenue and half of its growth (those respectively grew organically 12% and 19%). They are used to drive sales and efficiencies via real-time customer insights, direct customer relationships, and new digital media offerings.

The investment in data and technology is happening in other holding firms as well. IPG’s Media, Data and Engagement Solutions segment experienced significant organic growth, led by double-digit growth at IPG Mediabrands (which includes Magna, UM, and Initiative). Agencies also leveraged enterprise marketing suites like Salesforce and Adobe as part of their marketing stack but also built their own tools or acquired them to expand their offering. WPP acquired Regtargetly, Tremend, and Yieldify in 2022 to strengthen its e-commerce capability. Publicis acquired Profitero Limited, a world-leading SaaS platform in “Commerce intelligence”. This is good news for brands. Advertisers are increasingly relying on this type of rich data and technology skillsets to remain competitive and support their demanding transition to first-party data, direct-to-consumer and e-commerce priorities.

Socially responsible with a sustained commitment to people and the planet:

Holding companies are promoting responsible marketing and actively pursuing social agendas like diversity, equality and inclusion; anti-racism; and mental health, as well as better environmental practices.

The fight against climate change was particularly poignant in 2022. For example, creative agencies may have historically flown to thousands of locations all over the world, transporting talent, crew, sets and equipment. It’s estimated that the carbon footprint of an average shoot is 1 – 2 tonnes co2e. It’s clear that the production and content creation is responsible for a substantial proportion of the total carbon footprint of the marketing and communications process.

Leveraging creative production arms like Hogarth, holding companies like WPP are increasingly using virtual studios and real-time camera-to-cloud technology, removing the need for location shoots, and allowing clients to see the results in real-time from anywhere.

Holding companies achieved remarkable progress in that regard, specifically across the creative and media spectrum, sharing specific goals and accomplishments and appearing on the Dow Jones Sustainability World Index. WPP is seeking for its operations to be net zero by 2025 and for its supply chain by 2030. Other holding firms are committing to similar goals, leading in that area and support their clients’ own agendas. Agencies and advertisers are both seeking to balance a complex set of social and environmental challenges with evolving consumer expectations and constant technological advancement. Advertisers are partnering with their agencies to reduce the environmental impact of their work and move towards net zero while producing the very highest-quality work at scale.

Advertisers to Benefits from Expected Sustained Momentum

Earning reports from the top four holding companies reveal that they are cautiously optimistic about the future, forecasting mid-single digit organic growth despite the current economic headwinds. For example, Publicis Groupe forecasts organic growth between 3% and 5% with operating margin rate between 17.5% and 18% in 2023. Global economic challenges, including the geopolitical impact of the war in Ukraine, the COVID-19 pandemic, rising inflation and the risk of global economic downturn, rising interest rates and vast supply-chain disruptions contribute to economic uncertainty and volatility. Yet agencies expect to sustain the momentum they have built since the pandemic, delivering strong growth and top-notch operating margins. And as their clients, advertisers will continue to reap the benefits.